The foundry industry is one which is directly and indirectly affected by an incredibly diverse range of industries in the global economy – from automotive to hospitality, there is a requirement somewhere in the supply chain for the products and materials produced in foundries.

After an incredibly challenging period for industries and organisations worldwide, we look to be heading towards the “next normal”. With additional geopolitical pressures and massive global issues like climate change adding more complex challenges, the foundry industry will require investment and development over the next few years to remain sustainable and profitable.

In this article, we take a look at the trends and challenges in the foundry industry in 2021, and where we might go from here.

The foundry industry in 2021

Although we’re not quite in the position to be declaring we’re in a post-COVID world, we’re certainly in a very different landscape to where we were this time last year – and signs of recovery are showing in many industries.

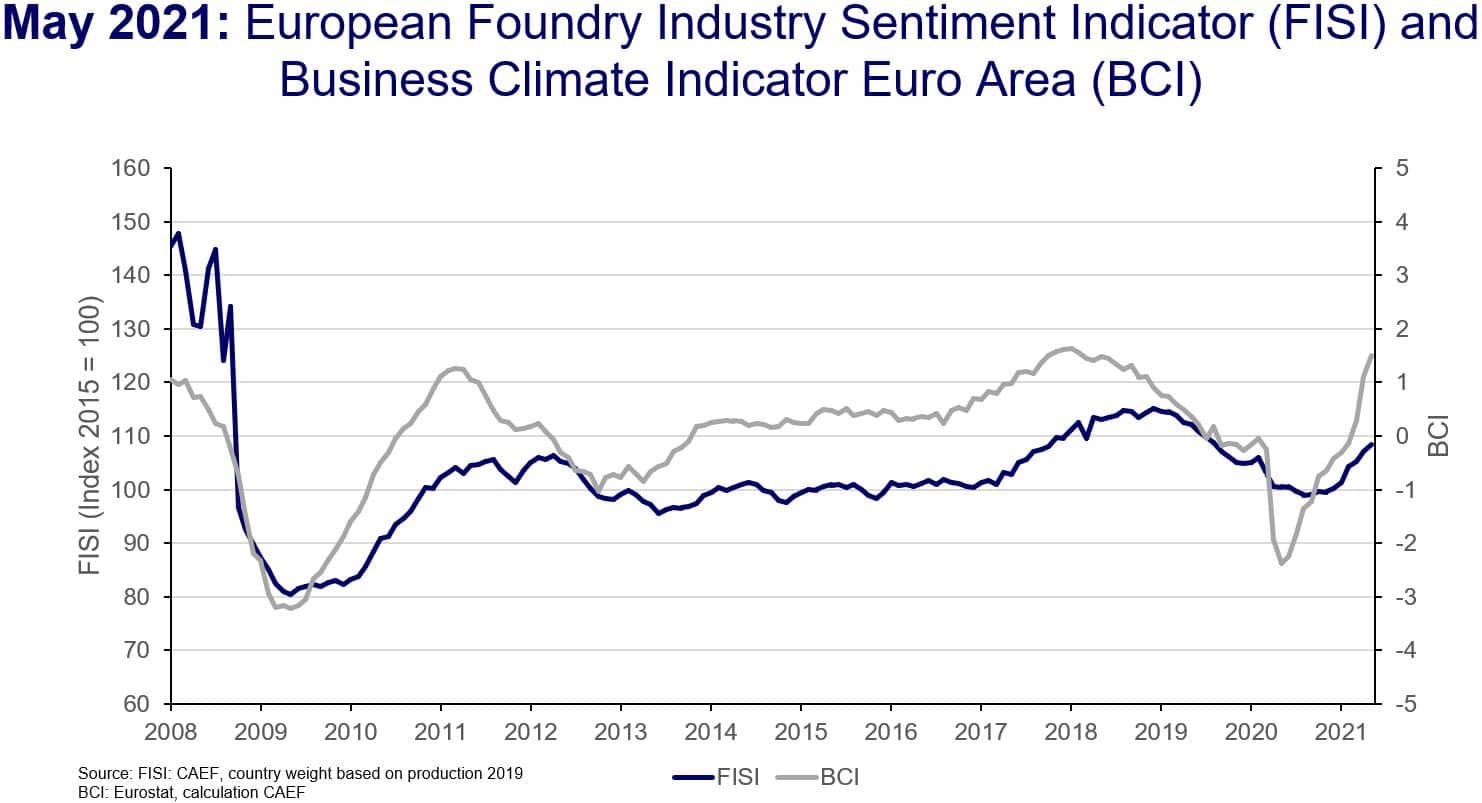

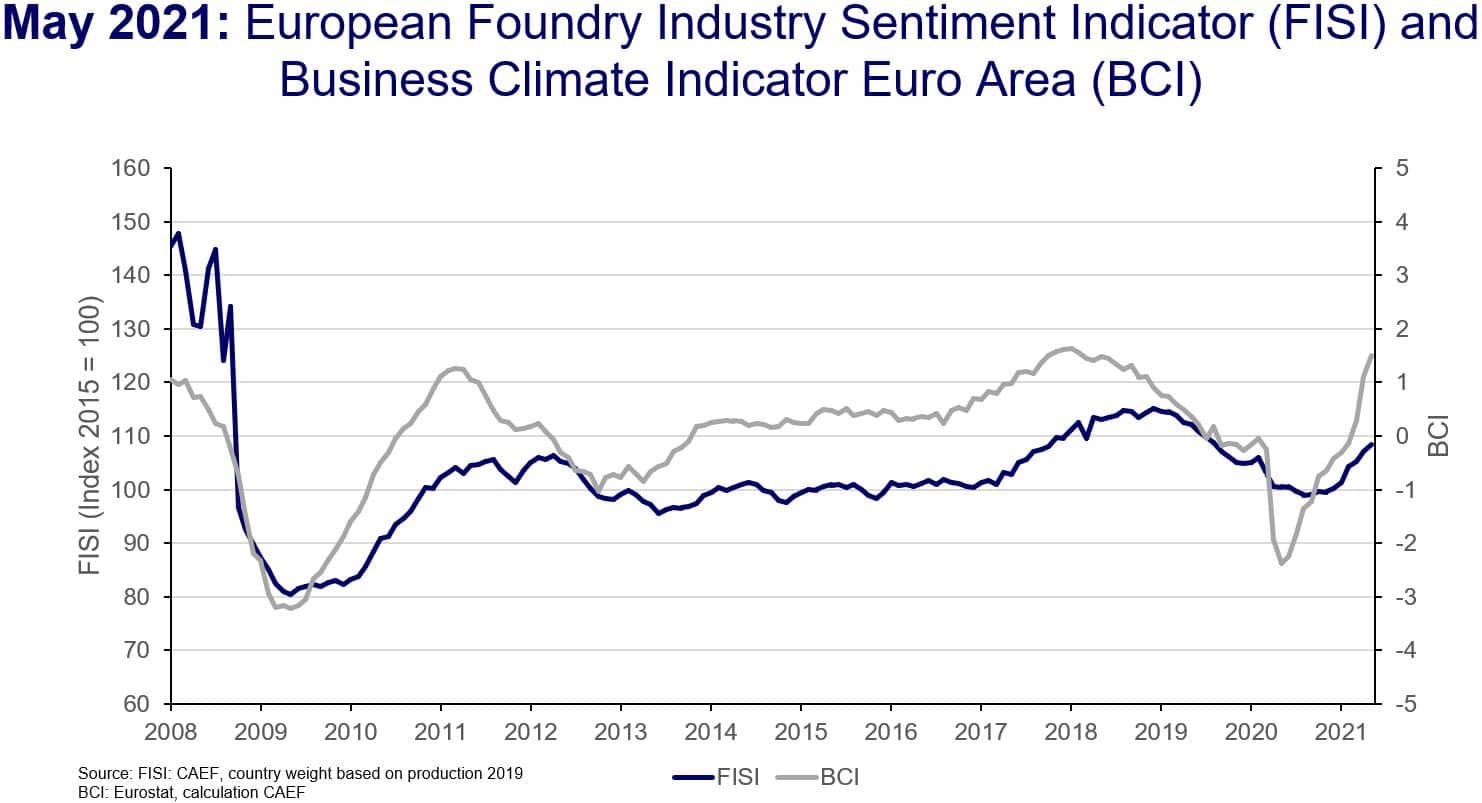

The European Foundry Association’s monthly report on their Foundry Industry Sentiment Indicator (FISI) for May shows 108.3 index points, 1.1 points above the previous month’s – continuing a steady increase which has been occurring for 6 months, something they refer to as a “robust recovery”.

Source: https://www.caef.eu/european-foundry-industry-sentiment-19/

Despite the optimistic picture that these indicators present, there is still concern around continued problems in the industrial supply chain and material bottlenecks exacerbated by international restrictions which could cause further disruption and hinder any significant development.

The foundry industry relies heavily on the automotive sector – and lower demand caused massive losses last year. The semiconductor shortage earlier this year which had a massive impact on the automotive industry could have had a knock-on effect in some corners of the foundry industry, leading to lower demand from a sector they heavily rely on.

That being said, the easing of contact restrictions in Europe is having a positive effect on hospitality and tourism, and as a result of a more buoyant economy, consumer spending is increasing – which will no doubt lead to an increase in demand for the foundry sector.

Net-zero

We are another year closer to the 2050 deadline of net zero-carbon in the UK. Heavy industry accounted for around 60% of emissions in 2019. The extremely high temperatures at which foundries operate mostly require the burning of fossil fuels – and the industry is expecting to face challenges in this area in the coming years and decades as the need to move away from this and towards alternatives becomes stronger.

Businesses in the foundry industry will need to significantly scale up their focus on lowering carbon emissions in order to meet the government’s targets. As we covered in our previous blog post, alternative methods of generating heat are being explored, including electricity and renewables, but further development is required to make the implementation and usage of this technology sustainable. Other options include implementing measures to offset the carbon emissions produced by the foundry industry – including carbon capture, utilisation and storage.

Elmelin are working closely with customers in the foundry industry to develop innovative solutions for a sustainable future. If you’d like to find out more – get in touch.